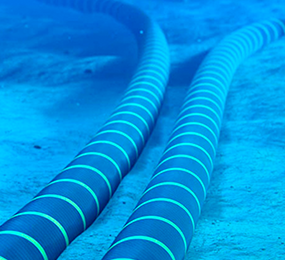

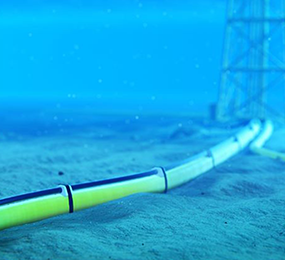

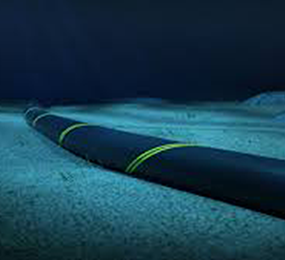

Financing Submarine Power Cable Projects

Financing large-scale submarine power cable projects requires innovative and strategic approaches. Given their substantial capital requirements, project developers often turn to a combination of funding sources. Traditional methods include bank loans, corporate bonds, and equity investments. However, due to the high-risk nature of these projects, alternative financing mechanisms are gaining traction.

Public-private partnerships (PPPs) have emerged as a viable option, sharing risks and rewards between governments and private entities. Additionally, multilateral development banks and export credit agencies can provide crucial financial support and risk mitigation. Furthermore, exploring green bonds and impact investing can attract environmentally conscious investors. By carefully considering these financing strategies and mitigating risks, project developers can secure the necessary funds to bring these critical infrastructure projects to fruition.

Visit our website to know more: https://www.leadventgrp.com/events/4th-annual-submarine-power-cable-and-interconnection-forum/details

For more information and group participation, contact us: [email protected]

Leadvent Group - Industry Leading Events for Business Leaders!

www.leadventgrp.com| [email protected]