An interconnector means a cable or overhead line connecting two power grids or pricing areas” although according to the EU context it is described as “a transmission line which crosses or spans a border between member states and which connects the national transmission systems of the member states”

The two parties involved whether countries or markets require an agreement between them as they cannot be carried out by a single transmission system operator (TSO).

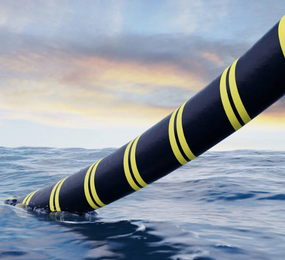

Historically, Interconnector development was initiated due to several supply chain challenges, the motive to share capacity, and also to benefit from the cross-border trading opportunities. In the early stages, HVAC interconnections were mostly and widely used but due to innovations in technology and also the need for cables to run both underground and submarine, the AC technology can not function properly so therefore, the HVDC option was implemented and adopted as it has many benefits. Currently, ultra-high voltage alternating current (UHVAC) and high voltage direct current (HVDC) technologies are used to transmit power to far distances. For example, the EuroAsia Interlink, which runs through Israel - Hadera via Cyprus - Kofinou(first Powerlink connector) and Greece - Korakia, Crete(second Powerlink connector). Global cable interconnection is a very exciting topic to be discussed.

Interconnection is generally perceived as a medium to provide needed market access so as to enable expansion and optimization of renewable energy such as wind, wave, and tidal.

Other Benefits of Interconnection

-

Provision of ancillary services

-

Promotes Competition

-

Energy cost reduction

-

Growth and Expansion of renewable energy sources

Ownership and governance models

Regulated model: historically, Regulated ownership is the most common model used for interconnector development. Most jurisdictions including mainland Europe and the USA to date use a regulated model as their dominant approach toward interconnection. It is often seen as part of the regulated asset base made for the TSOs which generally sees development as a public project. Remember that interconnectors bring two markets or countries together, so the TSOs of those responsible will be needed to facilitate the development of any new interconnector both in funding and operations. The benefit of using the regulated model is the level of transparency and clear revenue which helps to increase investment in the development of the interconnector thereby reducing the capital cost of the development.

Cost allocation is one of the major challenges in the regulated model approach due to the involvement of many direct and indirect stakeholders. Although there have been many regulatory moves on how to solve the cost allocation issues for transmission expansion, especially in the USA, Australia, and Europe.

Merchant model: Although the regulated model is widely used and accepted and there are moves to reduce its barriers, it is still good to try other options/models which may be helpful in the incentivizing development of interconnectors.

The merchant model involves a third-party developer which proposes and develops the interconnector project. Interestingly, the third party will now take charge of the full risks and also the rewards involved. This approach is an efficient model where the price difference is an issue which in turn helps the development of the interconnector.

However, the market price fluctuations and differences affect the application of the model as development prices might rise or decrease.

Cap and floor model: This is a newly developed hybrid regulatory scheme that was first applied in Britain for the NEMO interconnector in 2013 and has been in use since then. It was initiated to mitigate the developing point that recent interconnector project investment in Europe is getting difficult to incentivize under the merchant model. To fight against this, a “cap and floor” regulatory model was created by the British Office of Gas and Electricity Markets, Ofgem, which is similar to the regulated model plus de-risking tool. This model approach is good for investment decisions and also revenue generation as everything is calculated including the forecasted revenues and capital cost.