Subsea cables are very essential in the growth of the global modern economy due to their crucial roles in electric energy transmission and also data communication transmission. Subsea power cables are considered a tool for sustainable development in the economic value of most offshore-based energy systems. Meta’s massive investment in the subsea power cable market in Europe confirms the foresight indices in the growth of the market community. Considering critically Europe’s GDP forecast for 2024 - 2027; we expect catalyzed development and possibilities in the subsea power cable market world. However, several policies regarding the Subsea power cable markets should be reviewed so as to obtain economic growth and maximize the Subsea power cable investments in the future. Policies affecting the subsea cable market can crawl back or catalyze the investment opportunities and also set back the economic value of the industry. Moreso, to obtain reliability and consistency, the submarine cable industries need to improve by developing new products and also advancing the use of the existing products to meet the basic need of its existence. To promote the plans for additional subsea power cables, some policymakers and the supposed international body should adopt clearer, streamlined, and more efficient processes and techniques to attract big investors and opportunities. For investors to come, uncertainties, monetary running costs and time should be reduced to the minimum, for example, the cost for full permitting and licensing needs to be evaluated. In addition, the policymakers need to remember the main aim of the industry as any increment or extra costs will not only impact negatively on the industry but also on other dependent industries. For instance, if the costs are not reduced, there will be a high rate of inferior and fake subsea power cables.

For developed areas like Europe, The technological and strategic positioning needs to be able to accommodate the massive development of new submarine cables so as to increase demands both locally and globally. There must be connectivity to meet the sensitization of new infrastructures and products in the submarine cable market community as development is a continual process.

Opportunities for Submarine Power Cable Market

The constantly increasing investments in the renewable energy sector such as offshore wind farms and intercountry power transmission projects are also rising the demand for the submarine power cable as both work interchangeably together. Many major investments are taken place in the submarine power cable market globally, especially in the interconnection of power transmission between countries. Some of the major HVDC submarine power cable project includes IceLink, MSNLink, NorthConnect, NorLink and NorGer, UK Western Link, IFA2, NemoLink, Euro-Asia Interconnector, Labrador-Island, Maritime Link, India-Sri Lanka Interconnection, Sumatra-Java, and many others. These investments by several countries across all submarine power cable market communities are expected to drive in more revenues in the future.

Submarine Power Cable Market: Type Overview

According to the Insight partners, The submarine power cable market size is projected to grow to $11.82 billion by 2028. There is an estimated growth at a CAGR of 6.4% from 2021 to 2028. The submarine power cable market is divided according to type namely; single-core and multicore. The single-core power cables drive more massive revenue and income as they are used for the interconnection of power grids in the wind farms and also the offshore oil and gas sector. Most investments done in the submarine power cable market are in single-core industries due to its increasing power in the growth of the Submarine power cable market generally. The conductor materials for Submarine power cables are also of two different kinds which are Aluminium and Copper. Notably, the use of aluminum as the conductor is considered the best as it is more affordable, easier to install, and also faster. They are also divided by the type of voltage used. High-Voltage Direct Current (HVDC) cables are estimated to account for the hugest market share in submarine power cables with time, they are advantaged in many ways as they are used for system interconnection and also transmit power energy over longer distances. The rising demand for HVDC cables foreseen possibilities and development in the submarine power cable market.

Typical Funding Requirements for Submarine Cable Projects

As relatable in any huge Infrastructural project. There is a need to acquire huge upfront investments for the project which will be used to fund the operational expenditure likely to be met during the whole setup phase of the project. The funding requirement is split into the pre-financing and post-financing options. In general, financing can be used to provide for the direct funding of the prospective project or to secure a shareholder for the company.

Project Financing: As always, projects in developing countries are mostly financed with the support of Development Financial Institutions known also as DFIs. the DFIs are backed up by the developed countries which provide guarantees to risky loans, direct financing, or more even, equity contribution to a project considered to be beneficial to the development and economic growth of underserved countries and regions. However, the lack of recent precedent is a major barrier to the project financing of new submarine power cables as there is no existing plan or mindset on how the market is going to out.

The dormant approach to running a successful Submarine Power cable project is the consortium model. It involves sharing the costs and risks among a number of participants. Each person who invests in the project automatically becomes a co-owner and receives an allocation of capacity on the project in accordance with its equity interest.

The Brexit Referendum: How it can Affect Investment Decision

The impact of the Brexit referendum on most UK firms cannot be unnoticed. It reduced investments both local and international investors are afraid of what might happen next. Productivity is reduced since its announcement as most investors are withdrawing their monetary values in most UK-based industries even when the referendum is yet to be effective.

The impact of Brexit on UK firms: reduced investments and decreased productivity.

The UK’s decision to leave the EU has generated a constant rise in uncertainty. Even though the UK’s decision has not been implemented, the withdrawal process is making a huge impact on businesses based in the UK. Investment is estimated to have been approximately 11% lower than it should have been if not for the referendum. Over the same period, the anticipation of Brexit is estimated to have reduced the level of many UK firms' productivity as most are working and planning ahead for the proposed exit. In addition, Brexit is very important to consider when trying to work on any huge project due to reduced investment, manpower shortage, and low productivity.

Other Factors that Affect Investment in New Submarine Cables

-

Competition

The submarine power cables market is partially consolidated, due to the small number of companies operating in the industry. It automatically becomes had to compete with the key industry players be it in terms of the introduction of a new product or the opening of a new firm as they are already grounded in the system and how it operates. The key players in this market include Prysmian Group, NKT A/S, Nexans SA, Sumitomo Electric Industries Limited, ABB Ltd., and a few others

-

Existing Options

When a new product or firm is established, there is a high tendency for the older ones to overshadow them no matter how innovative they are. It takes time to bring a newly innovated product to the limelight due to the existing options known. This reason also scares away investors as it takes time to start generating income from new products and firms.

In conclusion, the submarine power cable market is rapidly growing and booming. People are investing massively in its market as it is getting widely known globally However, innovations and development of new submarine power cables take time to make headway in the industry due to lack of funds, low investment rate, and public acceptance. More funding options are needed in this regard. For instance, In the case of running green hydrogen projects, the de-risking tool is very vital in financing as it makes project funding easier and better. It even draws in investors as the project cost is reduced to the minimum. Although it is only limited to Green projects. It is also needed in all other huge infrastructural projects to mitigate risks and maximize revenue.

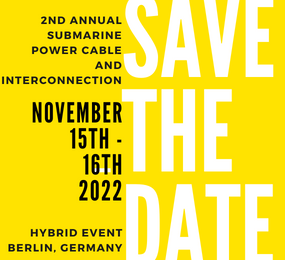

Try to register for our upcoming event "The 2nd Annual Submarine Power Cable and Interconnection Forum" for an in-depth understanding of Project Funding and Opportunities in the Submarine power cable Market Community.

Join us as we connect with industry experts, practitioners, stakeholders, and leaders from across the globe to garner ever-evolving knowledge on opportunities, the pros, and cons, and also the future of the Subsea community. The role and relevance of submarine cables in the global energy interconnection will be thoroughly explored. Click Here to Register

To request the agenda please send the request to Leadvent Group via email.

For more information and group participation, contact us: [email protected]