Subsea power cable market trend towards 132kV

Trends in Subsea Power Cable

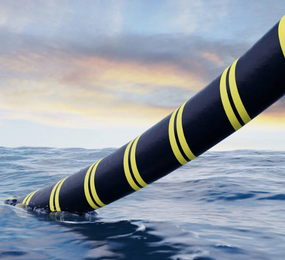

The fast expansion of the offshore wind sector has resulted in the development of several novel subsea cable technologies. This was primarily backed by a strong cable-related supply chain, which included prominent firms from manufacturing, services, and education from all over the world. Subsea power cable demand will continue to rise rapidly to serve both future offshore wind growth and the subsea power interconnector industry.

Export cables are essential for transmitting produced power to the grid. The operating offshore wind farms make use of 62 export cables totaling 1,499 kilometers in length. These cables' voltage ranges range from 33kV for nearshore wind farms without offshore substations to 132kV, 150kV, and 220kV for farther offshore locations with one or two substations.

Export Cable Trends: R&D activity has resulted in the development of new cable technologies. Since 2013, more than 80% of European projects have used export cables with voltages greater than 150kV. 80% of projects commissioned in 2018 will use cables with a voltage level greater than 200kV, reflecting the rapid development of cable technologies.

Development of Array Cables: There are about 1,806 kilometers of inter-array cables in the sea. Offshore wind projects will continue to grow in scale in order to optimize generating income and achieve Levelized Cost of Energy reductions. As a result of the increasing number of turbines and the distance between them, the lengths of array cabling needed are predicted to rise.

Manufacturers of Array Cables: The cable market is typically worldwide in scope, and there are several vendors accessible. JDR cables have had remarkable success, supplying multiple offshore wind projects as well as several abroad projects. Costs are projected to be reduced as the industry expands and an indigenous supply chain grows.

Market players agree that existing subsea cable project efforts are fragmented, and that a more structured and coordinated approach is needed to bring potential technologies and concepts through development and demonstration. Proposed concepts for developing a subsea cable database - which informs and enables stakeholders to identify and bridge gaps in innovation - have been met with skepticism from a number of system owners and operators; questions remain about whether a live, regularly-updated database would provide ongoing value and longevity.

There is little doubt that the offshore wind sector will continue to grow in the next decades. Future wind farms will employ larger turbines and be positioned further offshore, necessitating the deployment of durable cable technology as well as safe installation and operational methods. The sector must learn from the larger industry and exchange knowledge and lessons gained in order for costs to continue to decline, allowing the offshore wind supply chain to continue its upward trajectory.

Visit our website to know more: https://bit.ly/3zWlx4i

For more information and group participation, contact us: [email protected]

Leadvent Group - Industry Leading Events for Business Leaders!

www.leadventgrp.com| [email protected]

#subsea #subseaengineer #Reliability #assetsmgmt #managementofenergycontrol #reliabilityfail #reliabilitymatters #reliabilitystartshere #Cables #subseacables #water #waterproofcover #waterproofcables